Funds Borrowed for Schools, County Roads, Stormwater Projects

Harford County held its annual bond sale Tuesday, borrowing funds at one of the lowest rates in county history.

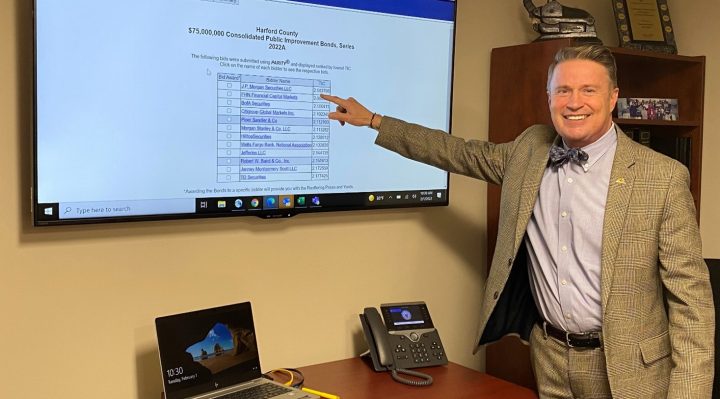

The county sold $75 million in AAA-rated consolidated public improvement bonds to winning bidder JP Morgan Securities at a rate of 2.1%, which represents the eighth consecutive year the county has been able to borrow at under 3%. The bonds will be paid back over 20 years.

More than half of the proceeds from the new bonds will fund education projects, including Havre de Grace Middle/High and Joppatowne High. The new bonds will also fund roads, bridges, and stormwater and wastewater projects.

In addition, the county refunded at a lower interest rate $29 million in bonds originally issued in 2012, for a savings of $2.6 million over 10 years.

Harford is one of fewer than 2% of counties nationwide with the highest possible AAA bond rating from all three major independent bond-rating agencies: Fitch, Moody’s and Standard & Poor’s. The top ratings reduce the cost of borrowing when bonds are sold to pay for priority capital projects.

“I am proud that my administration’s strong fiscal management has kept borrowing costs historically low for projects that improve the quality of life for our citizens,” County Executive Barry Glassman said. “Today’s bond sale reflects confidence from the investment community in our local economy and in county government, and it will save taxpayer money for years to come. I would like to thank my Treasury and Budget teams for helping us achieve these outstanding results.”

Bond-Sale-Projects